Before we get started, I want to tell you that I’m not a financial advisor, nor do I play one on the Internet. So keep that in mind when you are reading this. This is all my opinion based on the information I personally have consumed and shouldn’t be used as financial advice to you. I think that’s legally a good start to kinda pre-frame this whole article.

The easiest way to start investing in dividend stocks is to review a list of dividend stocks and buy one. You can read a list of recommended dividend stocks in The Morning Dividend, which will show you a list of stocks that pay dividends.

Okay so now that has been addressed, if you still want to learn more about dividend stocks I’ll go in more detail about what I know.

What Is A Dividend and How Does It Work?

The first thing we need to really understand is what a dividend actually is. In its simplest term, a dividend is a way for a company to reward a shareholder for owning a stock, usually in the form of cash.

Most of the dividend-paying companies payout on a regular basis (usually quarterly) which means if you own a share of their stock, you’ll be paid a dividend 4 times a year.

So for example, AT&T Stock symbol $T is a dividend-paying stock. As of the time of writing this article, September 10, 2020 at 1:11pm the price of 1 share of AT&T stock is $29.12. That means if you buy a share of AT&T for $29.12 today, you will be able to receive a dividend payout when the payouts happen.

I’m going to be using “$T” and adding a dollar sign $ before each stock mentioned throughout the article. For me personally, it makes it easier to recognize that I’m referring to an individual stock and not just putting random letters in the article. That means AT&T will be $T, if I say Target it’ll be $TGT, etc.

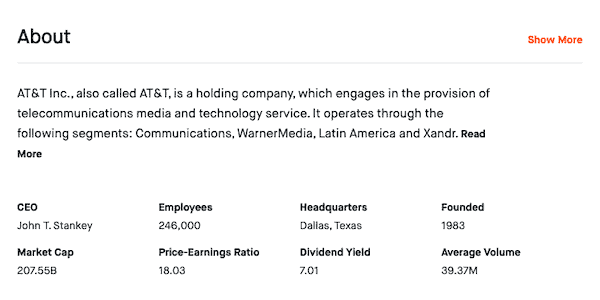

As of today, the dividend yield for AT&T is 7.01 here’s a screenshot of AT&T from Robinhood:

Click here to get 2 FREE Stocks from WeBull

What Is A Dividend Payout?

The dividend payout is the amount of money that you are paid out as a dividend for owning a share of the stock. For example (sticking with AT&T) the current dividend payout for AT&T is $0.52 quarterly.

You can look up the dividend payouts for different stocks on Nasdaq.com here is the direct link to see the dividend payout of AT&T.

What is A Dividend Yield?

The dividend yield or dividend-price ratio of a share of stock is the dividend per share, divided by the price of the share.

Using AT&T as an example: a quarterly dividend of $0.52 is an annual dividend of $2.08. The 7.01% yield is calculated by the $2.08 divided by the share price. At the time the 7.01% was reported as your return on investment, the AT&T stock price $29.67.

So, as you can see above, $T has a dividend yield of 7.01 which was calculated by the annual dividend payments divided by its share price.

Let’s use an example of the stock price dropping to $28.50.

If the stock price drops to let’s say $28.50, the dividend yield will also update. $2.08 / $28.50 = 0.073 or 7.3%. In this instance, you are basically buying a higher return on your investment, for a lower price. It’s like “buying income at a discount”.

It will also mean you’ll be able to buy more shares because the price was lower.

When Are Dividends Paid Out?

Most of the dividends that you’ll learn about are paid four times a year, or quarterly. However there are some companies that pay semi-annually (twice a year), others are annual dividend payouts (once a year) and there are some that pay out monthly. Some companies also have “irregular” dividends, but that’s not what we’re looking for.

For me, I like to find dividends that pay out quarterly and have a history of raising dividends over the last 5 or more years.

The easiest way to find out when dividends are paid out is on the Dividend Calendar on NASDAQ. That’ll open up a new tab so you can save it for later.

Planning Your Dividend Empire

As we mentioned up above, the price of AT&T is $29.12. Let’s say you have $10,000 that you are investing into dividend stocks.

For $10,000 at the price of $29.12 per share, that means you could buy 343 shares of AT&T. AT&T pays a quarterly dividend of $0.52 per share owned. Here’s a look at the chart from NASDAQ about AT&T.

| Ex/EFF DATE | TYPE | CASH AMOUNT | DECLARATION DATE | RECORD DATE | PAYMENT DATE |

|---|---|---|---|---|---|

| 07/09/2020 | CASH | $0.52 | 06/26/2020 | 07/10/2020 | 08/03/2020 |

| 04/08/2020 | CASH | $0.52 | 03/27/2020 | 04/09/2020 | 05/01/2020 |

| 01/09/2020 | CASH | $0.52 | 12/13/2019 | 01/10/2020 | 02/03/2020 |

| 10/09/2019 | CASH | $0.51 | 09/26/2019 | 10/10/2019 | 11/01/2019 |

| 07/09/2019 | CASH | $0.51 | 06/28/2019 | 07/10/2019 | 08/01/2019 |

| 04/09/2019 | CASH | $0.51 | 03/29/2019 | 04/10/2019 | 05/01/2019 |

If we run some simple numbers to make it super easy for us to see this. If we bought that 343 shares of AT&T and each share paid $0.52 quarterly, that means every 3 months we earn $178.36.

Makes sense, right? 343 shares x $0.52 per share = $178.36

$178.36 x 4 payments a year = $713.44 in dividend earnings for the year.

The way I like to think about this is that all the dividends earned get re-invested back into that stock. You can do this with a Dividend Reinvestment Plan aka DRIP.

Basically a DRIP is a program that allows investors to reinvest the cash dividends into additional shares or fractional shares. While the price of stock changes daily, AT&T will sell you shares based on the stock price on the day the dividend is paid.

So you might get a little AT&T for $29.54 or $31 instead of the original price.

If the price of AT&T goes up to $29.50 and you reinvested that first $178.36 from dividend earnings, you’ll be able to re-buy 6.046 more shares of the stock. $178.36 / $29.50 = 6.046 shares

If the price of AT&T goes down to $28.95 and you reinvested from dividend earnings, you’ll be able to re-buy 6.161 more shares of the stock. $178.36 / $28.95 = 6.161 shares.

You can calculate this for all of the different stocks as well, we’re just using AT&T in this example.

What’s cool in my opinion about this is that after that first dividend payout and reinvestment, instead of having 343 shares you’ll now have 349.046 shares. So that’ll bump up your earnings next dividend payout day from $178.36 to $181.48 since you’ll now have 349.046 shares instead of 343.

What is Compounding and Why it’s VERY IMPORTANT!

Recommended Resources for Dividend Investing:

Learn how to identify opportunity with the Stock Market Gems Course.

The Morning Dividend (email with information about dividends)