Disclaimer: I’m not a certified financial advisor and I don’t pretend to be on the internet. I’m just a guy on the internet who likes stocks and chooses to invest in them. This is not financial advice so please do your own research on every single thing I share here.

If you are a beginner with dividend stocks, please check out the article I wrote titled: How to Start Investing in Dividend Stocks

The goal of this article is to teach you how to create monthly cash flow from dividend paying stocks. Keep in mind that any time you start investing, you aren’t going to have life-changing income immediately. It is a game of patience, so don’t get down on yourself at the beginning.

I’m a fan of consistently adding to my portfolio over time. One way to think about this kind of investing is adding 10-15% of your income each month to your portfolio instead of waiting to invest until you have a ton of extra income. It doesn’t have to be that number specifically, I’m just using that as an example. You can start with 2-5% of your income.

Don’t Wait To Get Started

If you wait to start investing until you have a ton of extra income, you’re missing out on the compound interest effect. It’s always better to start sooner and that’s because of compound interest.

While it’s not 100% proven that Albert Einstein said this, I like to think he did because he was a smart dude.

“Compound interest is the eighth wonder of the world. He who understands it, earns it … he who doesn’t … pays it.”

– Albert Einstein (maybe)

Let’s look at an example of why compound interest is so important. Right now I have no idea how old you are, or what your financial situation is, so keep that in mind. You’ll need to change the ages and dates here to make sense for your unique situation.

If you are depositing $10 a month and it is compounding at 5% each year, that means your money will grow to $4,127.46 at the end of 20 years. If you were to just keep this money under your bed or just in a safe, you would have only had $2,400 at the end of the 20 year period.

Which would you rather have? The $4,127.46 or $2,400?

That’s why the idea of compound interest is so important to understand while we’re building up our portfolio’s. The quicker we start compounding, the more it adds up over time.

How Much Money Do I Need To Get Started Investing In Dividend Stocks?

Great question! It’s honestly a lot less than you might think. For example, it’s December 5, 2020 and you can buy a share of the AT&T company ($T) for less than $30. As of me writing this, the price is $29.53 per share and AT&T currently pays a dividend each quarter of $0.52 so that means each year one share of AT&T pays you $2.08 in dividends. That’s a 7% return on your money.

I use $T to describe the stock because it reminds me that it’s for stock ticker T, so when you see me write out a stock symbol I add a $ in front of it so it’s easier for me (hopefully you too) to recognize it’s not an error in the article, but the stock ticker.

Free Share of Stock up to $1,000 on Webull

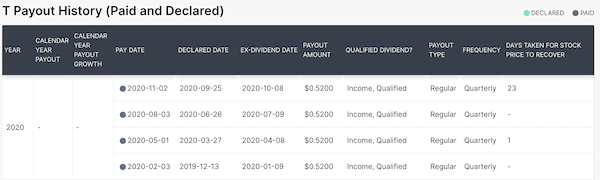

You can see the payout history by clicking here: AT&T Dividend Payout History. It will show you that they pay out in the months of January, March, June, and September.

This means that as long as you own a share of $T stock before the “ex-dividend date” you will be paid out a dividend. You need to own the stock before that date, or you will not be paid out on the “pay date”.

It’s a good idea for you to keep track of the months that each of these dividends pay out so that you can plan for the cashflow. For the most part at this stage in my life (I’m 33 years old), I plan on just reinvesting all of the dividend payouts back into the company that paid me instead of spending that money.

At a later date, I may use the dividends as a source of income that covers living expenses and fun experiences. But at this point in my life, I’m still actively building up assets and will reinvest everything back into the market. The decision really is up to you how you do this.

If you’re below the retirement age I’d recommend just reinvesting everything though, but that’s up to you to decide.

How to Plan Out Your Dividend Calendar

While I am not going to give you every single company that pays out dividends and all of their payout schedules, I will give you a few to get your mind racing and some idea of a consistent schedule.

It’s truly up to you to decide which stocks fit your portfolio and which companies you believe will have a future. There’s too many different possibilities for me to just say “you have to buy X stock and Y stock”.

There is however an incredible resource that you should look into when you are doing your own research. It is known as the Dividend Aristocrats.

Here is Yahoo’s list of 2020’s Dividend Aristocrats List: All 66 Stocks. This will open in a new tab, so it’s fine to click over to it.

What are the Dividend Aristocrats?

The Dividend Aristocrats are companies in the S&P 500 Index that have been increasing dividend payments annually for at least 25 years.

To me, that means that they are pretty secure and trustworthy companies, so they are worth considering as part of your portfolio. Truthfully though, it’s possible that any company could come under bad management and close so everything in life is a little bit of a gamble.

If a company stops paying a dividend, or cuts it significantly it may be disqualified from keeping in your portfolio. It’s up to you to make that decision.

I personally have a few mentors who recommend picking up companies inside the dividend aristocrats list as long as they pay out a 4% dividend. Any time a stock rises above that it is a good buy signal to them (as long as it is a sustainable payout rate).

If a company goes from paying a 3% dividend one month and then all of a sudden they are paying 20%, you can assume that something strange happened and it probably won’t be sustainable.

You do need to do your own due diligence on all these companies to make sure you know why the company is paying out the dividend.

The Four Common Patterns For Paying Out Quarterly Dividends.

Knowing these patterns will make it easier for you to plan out your monthly dividend portfolio.

- January, April, July, October

- February, May, August, November

- March, June, September, December

If you own one stock within each of these patterns, you’ll be paid dividends every month. It really is that straightforward.

Yes, I know it isn’t going to be life-changing income owning just 1 share of these stocks, but when you put it all together you can see the big picture. It always starts with that first dividend-paying stock purchase.

As always, do your own research prior to buying stock in any company. I said up at the beginning of the article I’m just a dude on the internet. I’m not a financial advisor or a professional, so always do your own due diligence.

Here are some stocks that pay out dividends in January, April, July, and October

Automatic Data Processing $ADP pays out a dividend in January. As of today, the price of the stock is $176.88 per share. According to Dividend.com the payout for January 2021 will be $0.93.

If you’ve got a calendar out for tracking this stuff, you can also mark down that $ADP pays out in April, July, and October as well. This will come in handy to schedule out your income.

The next stock that pays out in January that you can add to your portfolio is Franklin Resources stock ticker $BEN. Currently this stock is priced at $25.17 per share and the payout for January is $0.28 per share.

Let’s assume that you bought 1 share of both $ADP and $BEN last year so you qualify for the dividend payment coming up. You would earn $1.21 in dividend income in January. ($0.93 from $ADP + $0.28 from $BEN)

Not life changing, but it’s a start!

Dividend Stocks That Pay Out In February, May, August, and November

Another stock that pays out in February is AT&T stock ticker $T. As of right now, the stock price of AT&T is $29.53 and they’re expected to pay out $0.52 in February.

The next stock you can add to your portfolio for a payment in February is AbbVie Inc. stock ticker $ABBV which is currently priced at $104.35 with an expected dividend payment of $1.30 in February.

If you owned a share of both $T and a share of $ABBV you would get paid $1.82 in February ($0.52 from $T + $1.30 from $ABBV)

Dividend Paying Stocks that Pay Out in March, June, September, and December

We’re all familiar with the AFLAC Inc. duck with stock ticker $AFL. Aflac pays out in March, June, September, and December. Currently 1 share of $AFL is $44.81 with an estimated dividend payout of $0.33 in each of those months.

Another stock that pays you in March is Johnson & Johnson stock ticker $JNJ with the current price of $153.20 per share and it looks like the estimated dividend will be $1.01 per share each payout period.

Owning a share of both $AFL and $JNJ would pay you $1.34 in March, June, September and December.

Putting it all together…

Let’s just assume that you bought 1 share of each of the stocks mentioned above to create some monthly dividend income for you. We’ll look at the payouts put all together.

- January: $1.21

- February: $1.82

- March: $1.34

- April: $1.21

- May: $1.82

- June: $1.34

- July: $1.21

- August: $1.82

- September: $1.34

- October: $1.21

- November: $1.82

- December: $1.34

Of course, if you re-invest all of your dividends each of these numbers will increase a little as you will own more shares of each of the stocks.

In order to have this particular return, with all of the current prices of the stocks (listed above) you’ll have had to invest (one-time) $533.94 in order to receive this monthly dividend income.

Running the numbers (I love to do this) shows that the one-time investment of $533.94 will pay us a yearly income of $17.48. I know that doesn’t look like a lot, and the first year the return on your investment will only be 3.3% ($17.48/$533.94) which gets you 0.03273 and then multiply that by 100 to calculate the ROI. 0.03273 x 100 = 3.3%

If you simply cash out the dividend payments instead of reinvesting, you’ll receive the same 3.3% the next year and the next year as long as everything else stays the same.

However things tend to change, along with the list of dividend aristocrats (historically these companies raise dividends), so these numbers will fluctuate. If you reinvest all of the dividends your ROI just keeps going up.

If you simply cash out all the money for 5 years (5 x $17.48 per year) you’ll have received $87.40 in earnings. If you divide that by your initial investment of $533.94 that comes to an ROI of 16.4% after the 5 year period.

You calculate that by taking that $87.40 and dividing it by $533.94.

How to Make $100 a month from Dividends

Alright now let’s get to that $100 a month from dividends…

What’s cool (at least to me) about buying these dividends is that you don’t need to put down the huge sum all at once. At a certain point, the dividends you earn will end up buying more shares of that stock.

Let’s say that you start off with a $10,000 split between $ADP and $BEN at the beginning of the year. That would mean you bought $5,000 of each stock. This is purely hypothetical.

Reminder: There’s no way I know how much money you have or how much you are actively investing so keep that in mind.

We’ll use the numbers from above to keep things consistent.

If we spend $5,000 to buy $ADP at $176.88 per share that will get us 28.268 shares of $ADP, so the next time the dividend pays out (in April) we will get $0.93 per share we own. Sticking with round numbers that means we’ll have 28 shares x $0.93 per share, so $26.04 in dividend payments from this. We’re going to reinvest this, right?

With that initial $10,000 we also put $5,000 into buying $BEN at $25.17 per share. That buys us 198.649 shares of $BEN. $BEN is going to pay us $0.28 per owned share. We’re rounding here so we’ll say we owe 199 shares x $0.28 per share = $55.44 in dividend payments. We choose to reinvest that and that buys us another 2.2 shares at the $25.17 price point.

So the next dividend period we’ll have 198.649 shares from before + the new 2.2 shares you bought with dividends. That puts us up to 200.849 shares of $BEN. The next dividend payout will increase to $56.28 and we can reinvest that for the next time.

So all in all, the first dividend we receive from that initial $10,000 will pay us $26.04 from $ADP and $55.44 from $BEN. That means in April we’ll have a dividend income of $81.48.

With reinvesting this money, you can see how the compound effect kicks in. This is why it’s so important to start investing at a young age, you have the time for your money to compound.

February, May, August and November earnings…

I’m going to do the next few in a similar manner. That is going to assume you put $10,000 into 2 stocks for this group of dividends. As I said above, I don’t know your finances so I’m doing my best to keep this strictly based on easy numbers for me to calculate with.

In February we invest another $10,000 dollars this time splitting it between $T and $ABBV. $5,000 into $T would get you $5,000 / $29.53 = 169.319 shares of $T. The next time $T pays out $0.52 per share in May will mean you get 169 shares x $0.52 per share = $87.88 in dividend payments. That will buy you another 2.97 shares at the current price.

We’re also assuming no price change at all with these stocks, and prices always fluctuate.

The other stock we’re putting $5,000 into in February will be $ABBV at a cost of $104.35 per share. That gives us 47.816 shares of $ABBV that will pay out $1.30 dividend per share, so $62.40 in dividend payments in May. (Rounding to 48 shares)

that means we won’t be able to buy a full share of $ABBV with these earnings, but we can reinvest it still.

March, June, September and December earnings…

Let’s look at the earnings from March… we’re going to stick with that $10,000 invested between the two stocks from above. $5,000 goes to $AFL at a price of $44.81 per share so we can buy 111.58 shares of $AFL which pays $0.33 dividend in June. That means $AFL will pay us $36.63 (111 shares x $0.33).

The next up we’re going to put another $5,000 towards $JNJ which is priced at $153.20 per share. That means we get 32.637 shares of $JNJ on the initial purchase. That means we’ll get 32 shares x $1.01 in dividend payments = $32.32

That makes our dividend earnings for June (this cycles next payout) will be $68.95.

So it seems like you’re spending a lot of money in order to get a little back, right? In this example, you are investing $30,000 one-time in order to get these first 6 stocks. That only makes you around $75 a month.

I say only because it’s the first initial deposit. The beauty of this is when you reinvest all of these earnings back into the companies that are paying you these dividends.

After a while these numbers really start to compound and every new payment you earn will buy you more shares of that company, thus increasing your income down the road.

While this started out as a way for you to earn $500 a month through dividend payments, my hope is that you are starting to see the potential of growing this to cover other expenses in your life.

Many baby-boomers did this when they were younger and now live strictly off of income that they earn from their investments.

What Other Stocks Pay Monthly Dividends?

If you have heard of REIT’s, you are familiar with the idea of monthly dividends.

What is a REIT? A REIT is a Real Estate Investment Trust and is a company that owns, operates, or finances income-generating real estate. They don’t however offer much when it comes to capital appreciation. Part of their structure requires that they pay out 90% of the income back to investors.

You can learn more about REITS in this article from Investopedia. (Opens in a new tab)

There are more than 225 publicly-traded REITs in the U.S., which means you’ll have some homework to do before you decide which REIT to buy.

The good news is once you find a few and add them to your portfolio, you can start getting monthly dividend payments from these REITs.

A few REITs that I have personally looked into are Realty Income Corporation (stock ticker O) and STAG Industrial, Inc. (stock ticker STAG). I’m not recommending you go out and purchase them either. Do your due diligence and research to find companies that align with your goals.

As of me writing this article, $O trades around $60 a share and $STAG trades around $30 a share. $O pays a monthly dividend of $0.23 per share and $STAG pays a monthly dividend of $0.12.

With the initial $10,000 for the example, you could split that up into buying $5,000 worth of $O and $5,000 worth of $STAG. That would buy you 83.33 shares of $O and 166.66 shares of $STAG.

With those numbers, you would earn a monthly income of $19.17 from $O and $20 from $STAG, for a total monthly income of $39.17.

Now it’s up to you to start building your portfolio so that you can collect income from dividend paying stocks. I wish you the best of luck! If you’re looking to get started, you can use my link below to get a free stock from either Webull or Robinhood.